Self Assessment 2024

Self Assessment 2024. Self assessment tax is the portion of tax paid by individuals on their taxable income that is not subjected to tds (tax deducted at source) or advance tax payments. Most of the income tax changes announced in july 2024 will affect tax deductions and exemptions that can be claimed while filing an income tax return (itr) in july.

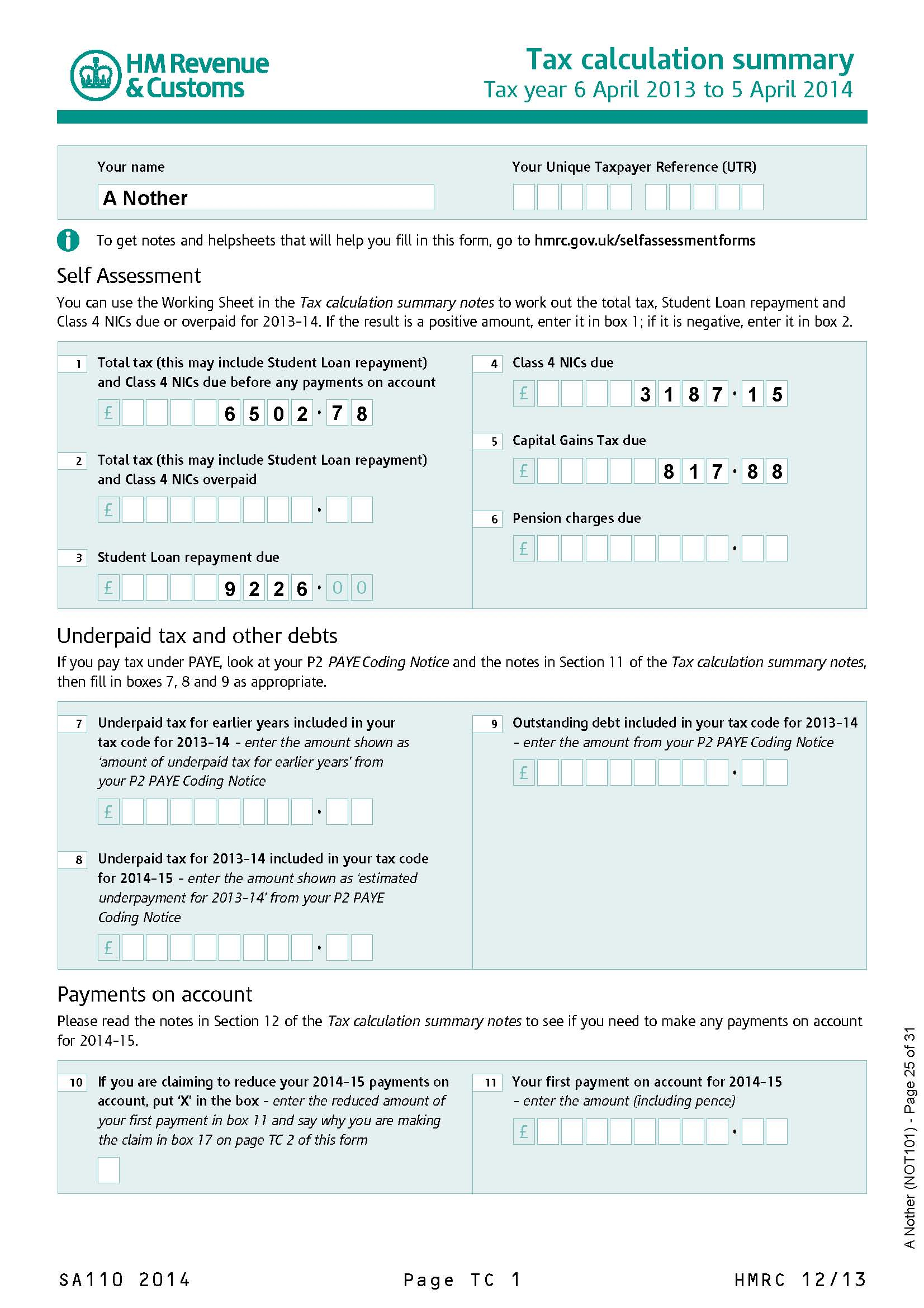

Report your income and claim tax reliefs and any repayment due to you using the sa100 return. How to report profit on your self assessment tax return from 2023 to 2024 if your accounting year does not end on or between 31 march to 5 april.

Self Assessment 2024 Images References :

Source: anna.money

Source: anna.money

Full Guide To Self Assessment Tax Return 2024, This will allow you to get your unique taxpayer reference (utr) number and activation code in.

Source: medcourse.co.uk

Source: medcourse.co.uk

CST Portfolio SelfAssessment Guide 2024 MedCourse, Or find dates for the 2025/26 tax year.

Source: helpfulprofessor.com

Source: helpfulprofessor.com

15 SelfEvaluation Examples (2024), The central board of direct taxes (cbdt) has brought relief to taxpayers by extending the deadline for filing belated and revised income tax returns for the assessment.

Source: www.dochub.com

Source: www.dochub.com

Ca self assessment Fill out & sign online DocHub, Use sa211 to help you complete the sa200 short tax return.

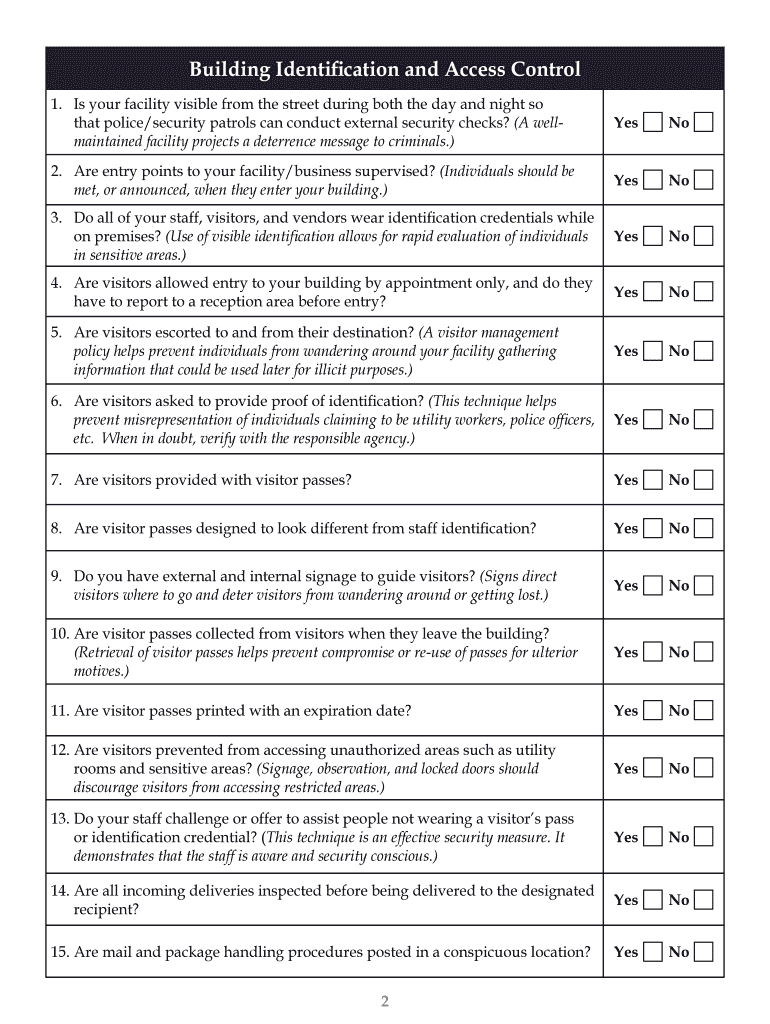

Source: www.signnow.com

Source: www.signnow.com

Facility Self Assessment Fill Out and Sign Printable PDF Template, This move, announced by cbdt, aims to.

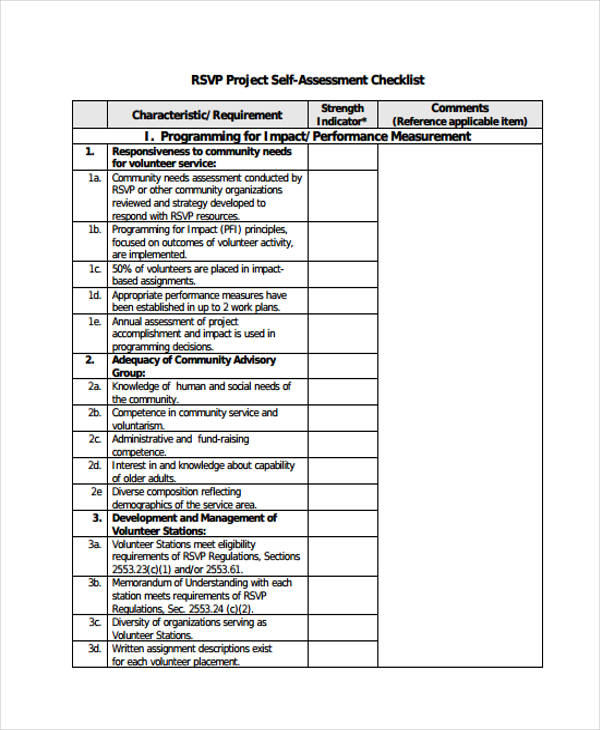

Source: www.sampleforms.com

Source: www.sampleforms.com

FREE 36+ SelfAssessment Forms in PDF MS Word Excel, The calculator uses tax information from the tax year 2024 /.

Source: www.youtube.com

Source: www.youtube.com

Electronic SelfAssessment Tool (eSAT) 20222023 YouTube, However, peer assessment can add more feedback.

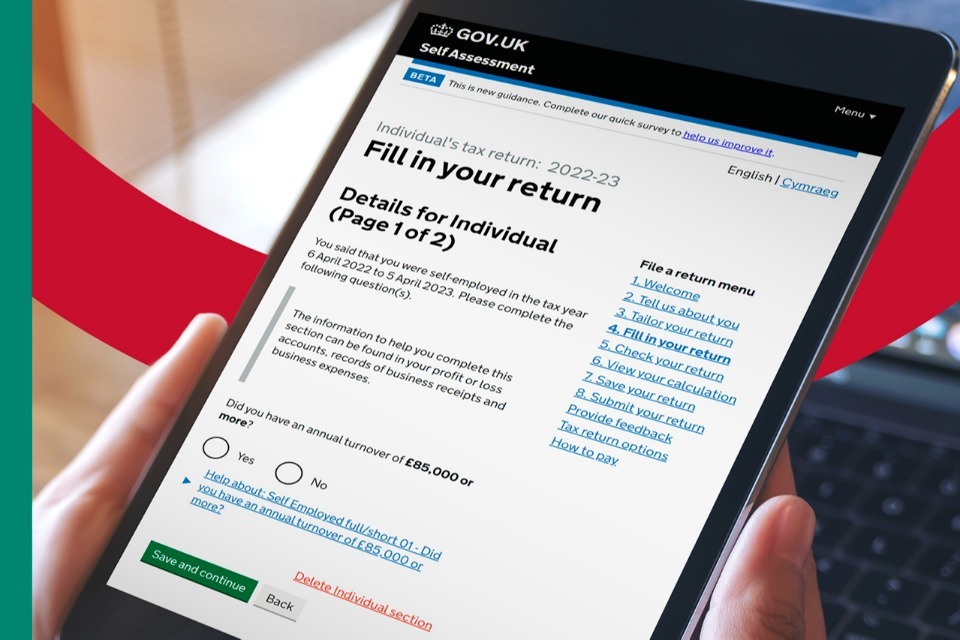

Source: www.gov.uk

Source: www.gov.uk

Self Assessment customers can help themselves by filing their tax, This will allow you to get your unique taxpayer reference (utr) number and activation code in.

Source: www.employementform.com

Source: www.employementform.com

Self Assessment Tax Return Form Employment Pages Employment Form, Our online service is available 365 days a year so there’s still a chance to get it done before.

Source: inclusiveschools.org

Source: inclusiveschools.org

Inclusion SelfAssessment Survey Inclusive Schools Network, This would be your return for the tax year starting on 6 april 2022 and ending on 5 april 2023.

Posted in 2025